Buying Your First Home

The process from start to finish!

1. Obtain Pre-approval Letter from Your Lender

Preapproval Letter is Entry to Make An Offer

Most Sellers will not accept an offer from a Buyer who requires financing to make their purchase without a "pre-approval" letter. The pre-approval letter is a letter that you obtain from your lender, showing that you are able to purchase a property for a certain amount of money. Most lenders will allow you to obtain such a letter on-line.

2. Work with a Realtor to Find Your Dream Home

Realtors Make the Process Easier AND THEY ARE FREE!

Buyers sometimes have the misconception that a Realtor costs the Buyer money. This is not true. The Seller has offered a commission to any agent who brings a Buyer to their listing. By working with an agent you have a trusted adviser who will represent your interests in the transaction. You are better off having your own agent who will look out for your interests as opposed to the interests of the Seller.

3. Make an Offer

The Offer Stage Sets the Basic Terms of Your Purchase

At the offer stage of the transaction, the basic terms such as price, closing date and other contingencies are agreed upon. It is important to include all financing requirements, such as grant money or special loan programs that you may be seeking. Do not forget to list all of the appliances that you would like to be included and a closing cost credit if you need help with closing costs. Be sure to address any other issues that you my have to resolve in order to purchase the property.

4. Hire a Lawyer

The Lawyer that you Choose should be a Real Estate Specialist

A real estate attorney will be needed to guide you through the contract negotiations, lender requirements, title examination, computations and adjustments for closing costs; and to review the closing package with you. The lawyer is the person who actually completes the transfer and provides advice along the way.

5. Enter into a Contract

The Contract that you Enter is a Multipage Purchase and Sale Agreement

Your real estate lawyer will assist you with reviewing the purchase and sale agreement to both make sure that you understand all of your rights and obligations under the agreement and to ensure that all of the terms that you want or need are in the agreement. Be sure to choose a great real estate attorney who will review the contracts with you over the phone. Ask about our first time home buyer program and other incentives for choosing PCA Law and Attorneys Nyles L. Courchesne and Kate Milligan for your real estate attorney needs.

6. Complete Inspections

Inspections are Vital to Home Ownership Success

In most real estate transactions the Seller has little or no obligation to disclose defects in the property. In this way, all real estate is sold with all defects (known and unknown to either Buyer and Seller). It is therefore, vital that the Buyer thoroughly inspect their home through licensed professionals. Most home buyers will have a termite inspection and structural inspection performed. Depending upon the location and amenities of the property a Buyer should consider additional testing such as well, septic, foundation and radon inspections. The purpose of the testing is to identify and defects and assess the long and short term needs of the home. A Buyer can use this information to negotiate repairs to be performed by the Seller or credits/price reduction in consideration of the condition of the property.

7. Complete Loan Application

The Loan Application has Two Major Components: Credit Worthiness and the Valuation of the Collateral

Your loan officer will need to complete an extensive review of your credit, work history and savings to determine your ability to repay the loan. There is a great deal of paperwork that you must provide to your lender in a short amount of time. It is important to quickly respond to all of their requests. Secondly, your lender will have to determine whether or not the property that you are purchasing is worth what you are paying. The lender will require you to purchase an appraisal for their use to confirm that you are not over-paying for the home.

8 Attorney Due Dilligence

Contract Reuirements, Title Examination, Tax and Municipal Lien Review and Mortgage Plot Plan Review

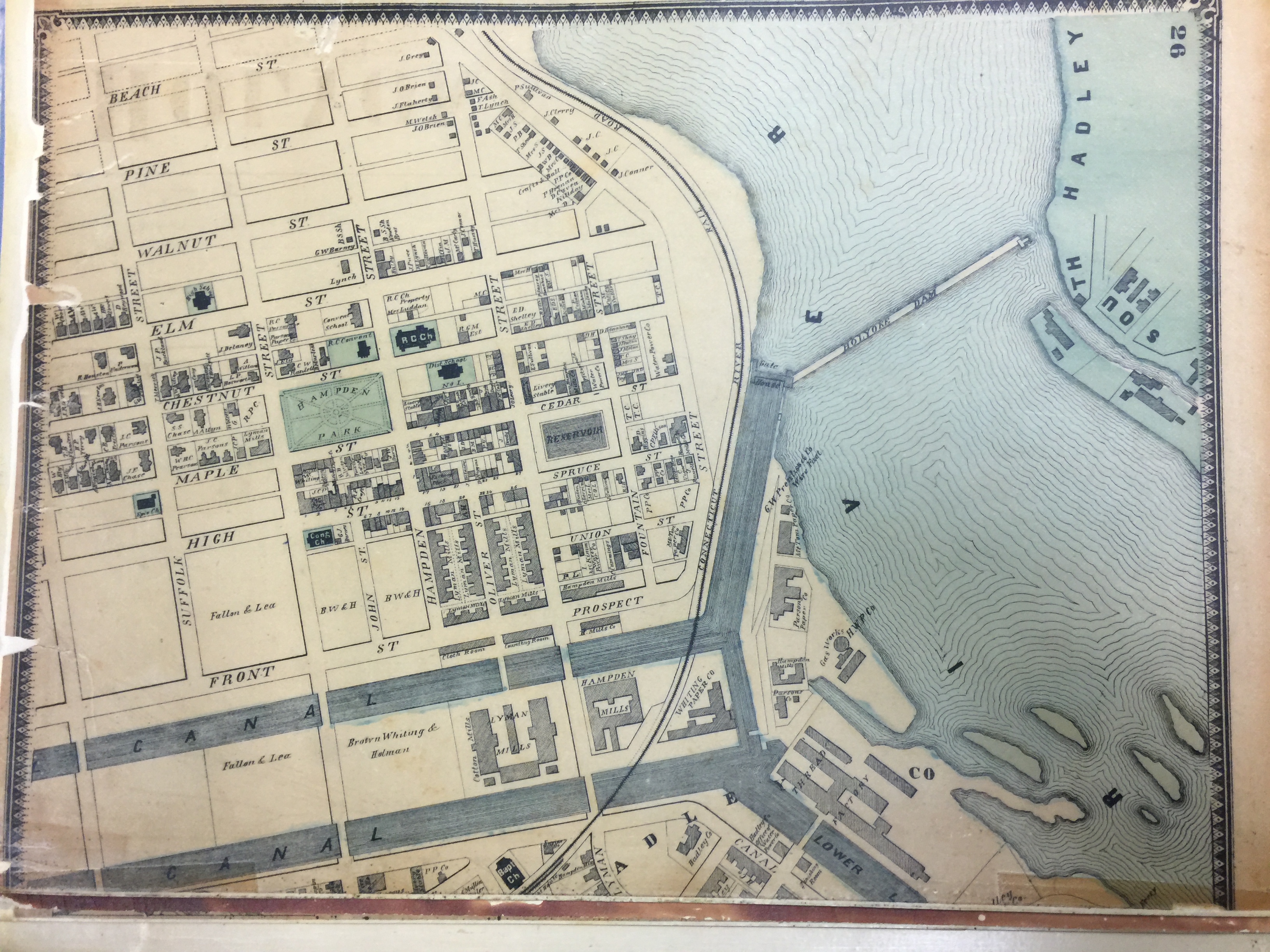

Your real estate lawyer will review a number of important items: 1) The attorney will see that all of the terms of your contract are enforced; 2) Provide a 50 year title examination of the property; 3) Order a municipal lien certificate for every taxable parcel of land that you are purchasing to make sure that the Seller pays their fair share of any taxes that are owed; 4) Review the mortgage plot plan to make sure that there are no encroachments (structures crossing boundary lines) or unexpected easements, rights of way, etc. . .

9. Walkthrough

Final Review of the condition of the Property

The "walk through" is the Buyer's final opportunity to assess the condition of the property in order to insure that it conforms to the condition promised in the contract. It is best to conduct the walk through the evening before, or morning of your closing. Your Realtor will schedule this review. At the walk through you are checking to make sure that the property is in good condition with all mechanical components working, that it is in broom clean condition, free and clear of all tenants and occupants and free of all of Seller's personal property. Buyers should walk through testing every light, switch, heat, air conditioning, all plumbing and inspect for any "move out damage", trash or personal property that Seller has left behind. Any issues can be dealt with at the closing table, but you should quickly formulate what will satisfy you as a Buyer so that you can close. Common resolutions include holding back Seller funds until repairs or removal of property can be completed or a credit for the cost of same can be credited to the Buyer.

10. Attend Closing

All Buyers Need to Attend the Closing and must Bring their Driver's License anda Certified Bank Check (Not a personal check)

At the closing the real estate attorney will review the walk-through results and will assist you in signing all of the closing documents. The closing is your final opportunity to address any issues with the property and to make sure that seller has met all of their obligations under the terms of the contract. Be sure to ask any and all questions at the time of closing. During the closing or soon thereafter, the attorney will meet with the Seller's attorney to exchange documents and funds and he or she will then record your closing documents so that you have title to your property.

11. Celebrate

Congratulations!

Buying a home is a major investment in your future. Enjoy the fruits of your labor throughout the process. Remember that you also hired an attorney who can help in the near and distant future , PCA Law Nyles L. Courchesne can help you protect your investment and your family through the preparation of simple wills, power of attorney and health care proxy package. He can also help